Managing personal finances can be daunting, especially with countless budgeting strategies available. One popular method that has stood the test of time is the 50/30/20 Rule, a simple and flexible budgeting guideline. This article explores what the rule entails, its advantages and limitations, and whether it might suit your financial goals.

What Is the 50/30/20 Rule?

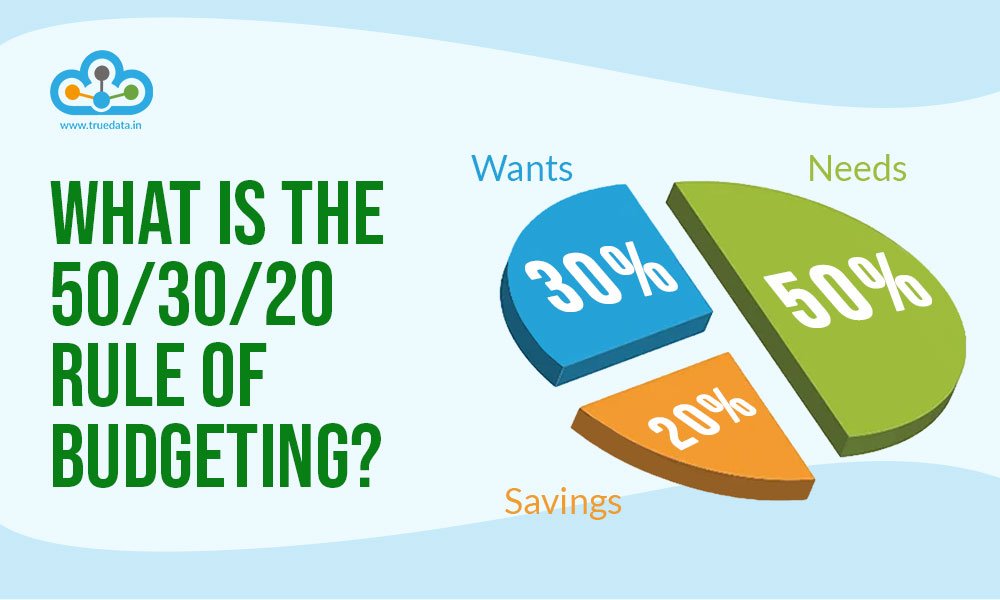

The 50/30/20 Rule is a budgeting principle introduced by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book “All Your Worth: The Ultimate Lifetime Money Plan.” It divides your after-tax income into three broad categories:

- 50% for Needs: Essentials you cannot live without.

- 30% for Wants: Non-essential expenses that enhance your lifestyle.

- 20% for Savings and Debt Repayment: Financial security and future goals.

This breakdown allows individuals to allocate their income thoughtfully, ensuring they cover their basic needs, enjoy life, and still save for the future.

Breaking Down the Categories

- Needs (50%) Needs encompass mandatory expenses crucial for day-to-day living. Examples include:

- Rent or mortgage payments

- Utilities (electricity, water, gas)

- Groceries

- Health insurance premiums

- Transportation (fuel, public transit)

- Minimum debt payments (credit cards, loans)

- Wants (30%) Wants are discretionary expenses—things you enjoy but can live without. Examples include:

- Dining out

- Entertainment (streaming services, concerts, etc.)

- Hobbies and leisure activities

- Vacations

- Luxury items

- Savings and Debt Repayment (20%) This portion is dedicated to financial growth and security. It includes:

- Contributions to savings accounts or emergency funds

- Investments (retirement accounts, stock portfolios)

- Additional debt payments (beyond the minimum)

Benefits of the 50/30/20 Rule

- Simplicity: Easy to understand and implement, making it ideal for budgeting beginners.

- Flexibility: Works with a wide range of income levels and lifestyles.

- Balanced Approach: Encourages a healthy mix of financial responsibility and enjoyment.

- Future-Oriented: Prioritizes savings and debt repayment, fostering long-term financial stability.

Challenges and Limitations

While the 50/30/20 Rule has its merits, it’s not one-size-fits-all. Some challenges include:

- High Cost of Living: In areas with high housing costs or expensive necessities, allocating just 50% of your income to needs may be unrealistic.

- Income Variability: For freelancers, gig workers, or those with irregular incomes, sticking to fixed percentages can be challenging.

- Debt Burden: Those with significant debt might need to allocate more than 20% of their income to debt repayment, leaving less room for wants and savings.

- Oversimplification: The rule doesn’t consider complex financial goals or situations, such as saving for a wedding or paying for childcare.

Is the 50/30/20 Rule Right for You?

The 50/30/20 Rule is a solid starting point for those new to budgeting. It provides a clear framework for managing your money and maintaining balance. However, its suitability depends on your personal circumstances:

- For Beginners: Ideal as an introduction to budgeting, especially if you need guidance on allocating your income.

- For Advanced Planners: You might need a more detailed plan that accommodates specific goals, like saving for a home or early retirement.

- In Tight Financial Situations: If your needs exceed 50% of your income, consider adjusting the percentages or focusing first on essentials and debt repayment.

Customizing the Rule

If the 50/30/20 Rule doesn’t perfectly align with your needs, customize it:

- Adjust the percentages (e.g., 60/20/20 or 70/10/20) to suit your financial reality.

- Prioritize high-interest debt repayment or specific savings goals.

- Use budgeting tools or apps to track your progress and refine your approach.

Conclusion

The 50/30/20 Rule offers a straightforward and practical guide to budgeting, promoting financial stability while leaving room for life’s pleasures. However, it’s essential to assess your unique financial situation and adapt the rule as needed. Whether you’re starting your financial journey or looking to refine your habits, this approach can be a valuable tool for achieving your goals.

Your turn: Have you tried the 50/30/20 Rule? What budgeting strategies work best for you? Share your thoughts in the comments!